The rules say that customers’ negligence - such as writing a PIN on a debit card - does not increase their liability.Ī customer would be on the hook for unauthorized transactions if she gives her card or credentials “and grants authority to make transfers to a person (such as a family member or co-worker) who exceeds the authority given,” the rules say. The banks’ warnings, however, are off base.įederal banking rules known as Regulation E ( here) sharply limit customers' liability for unauthorized electronic transactions from their accounts, provided they report the fraud promptly. “They don’t have the opportunity to cross-sell me.” “Mint makes it so I don’t have to go to the individual bank sites,” said Ranta. However, the same warnings infuriated heavy Mint user Mark Ranta, head of digital payments at ACI Worldwide Inc, who says the banks are far more worried about competition from these aggregation sites than about electronic safety. You don’t want to make it easier,” Armstrong said. The warnings were enough to cause Morris Armstrong, a registered investment adviser and enrolled agent in Danbury, Connecticut, to recently close his account with, a so-called aggregator website and a division of Intuit Inc. JPMorgan Chase & Co and Capital One Financial Corp, for example, warn on their websites that customers could be liable for any fraud in their accounts - even though federal regulations say otherwise.Ĭapital One's site ( here) tells users: "If you choose to share account access information with a third-party, Capital One is not liable for any resulting damages or losses."Ĭhase ( here) admonishes, "If you give out your user ID and password, you are putting your money at risk."

#LINK QUICKEN MINT UPDATE#

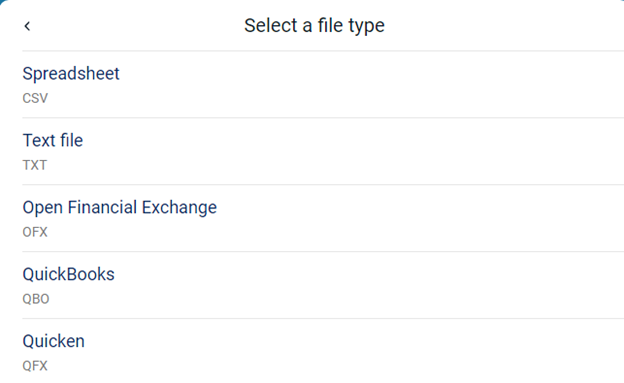

An “Update” button will appear if there are new transactions, and clicking it will update the spreadsheet.LOS ANGELES (Reuters) - Millions of people share their bank account passwords with third-party sites and apps that help them track their spending, but some of the biggest financial institutions, wary of hacking risks, are trying to scare people into not using them. According to Microsoft, transactions will not update automatically the spreadsheet, though the template will constantly keep an eye out for new additions. To add an account, you’ll need to go to the Accounts tab and click Add an Account. Money in Excel will track recurring expenses.

Money in Excel will divide up the worksheet into several tabs: a Welcome tab, an Instructions tab, and then separate tabs for a Snapshot overview, Categories, individual Transactions, and Recurring expenses. The connection between financial institutions like your bank will be managed by Plaid, which says that it has forged connections with 10,000 institutions across the United States. After granting permission for Plaid to connect a financial account with Money in Excel, Plaid will have access to the account’s balances, transaction history, and associated account information, like owner name and address, but not your Microsoft 365 login credentials, according to a Microsoft support document. Money in Excel will also use a dashboard to provide an overview of your spending.

(Money in Excel will also alert you if these change, Microsoft says.) Microsoft That data is stored and tracked within Excel, using analytics to measure changes in your overall spending, for example, or to track recurring expenses like Netflix that carry over from month to month. Money in Excel consolidates your accounts from various services: your credit card provider, your bank, as well as any investments and retirement accounts you may own.

0 kommentar(er)

0 kommentar(er)